Thanksgiving advice: Renaissance Ridge is okay to talk about.

High points from the November 21 meeting about the proposed Nellysford project.

The turkey is brining and my brain is marinating on the takeaways from a meeting I just left regarding the planned Renaissance Ridge development in Nellysford. The discussion was held at the Tuckahoe Clubhouse, a meeting space in Stoney Creek.

The community has raised a lot of concern over environmental impacts such a development could present to the Rt. 151 area, with traffic being one of them. The above slide reveals plans to add a deceleration lane as you approach the entrance from the north. Take note of point #5 above: That builder is Drew Holzwarth of Greenwood Homes, certainly not a rookie when it comes to developing subdivisions in Central Virginia. He’s the guy in the picture below to the right, a familiar face to those who may have had kids involved in the Wintergreen Ski Club, as he has owned property at Wintergreen Resort. Not sure when Renaissance Ridge will be added to the list of communities posted on his company’s web site, but it’s safe to say he’s the exclusive builder for this project.

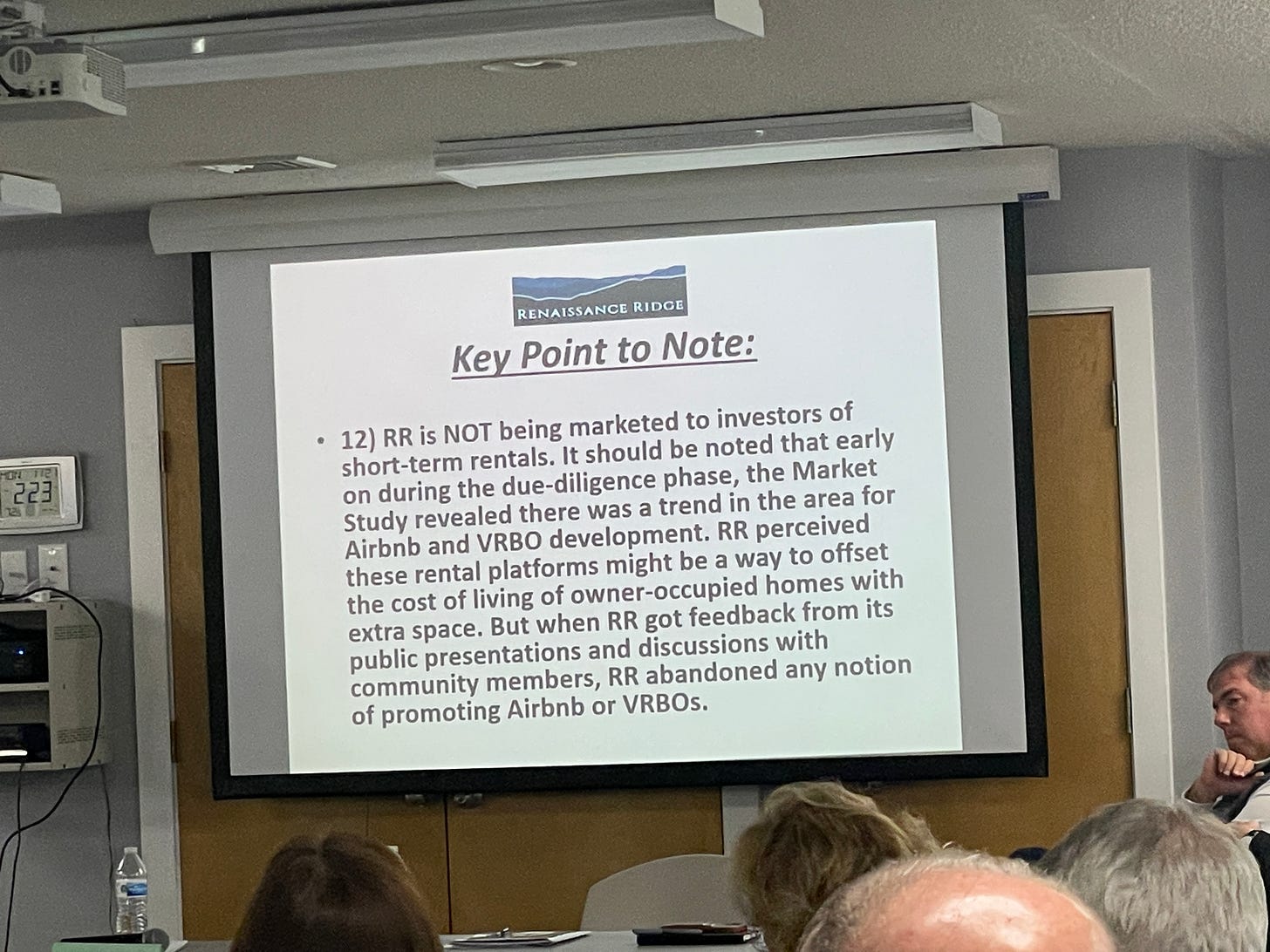

Another point that has caused a significant amount of local handwringing is the possibility that some of the units at Renaissance Ridge could be turned into Short Term Rentals. RR is walking back that concept and I imagine covenants or association docs to be drawn up could rule out that use, while retaining the ability of property owners to dive into the long term rental market, or at least have it as an option.

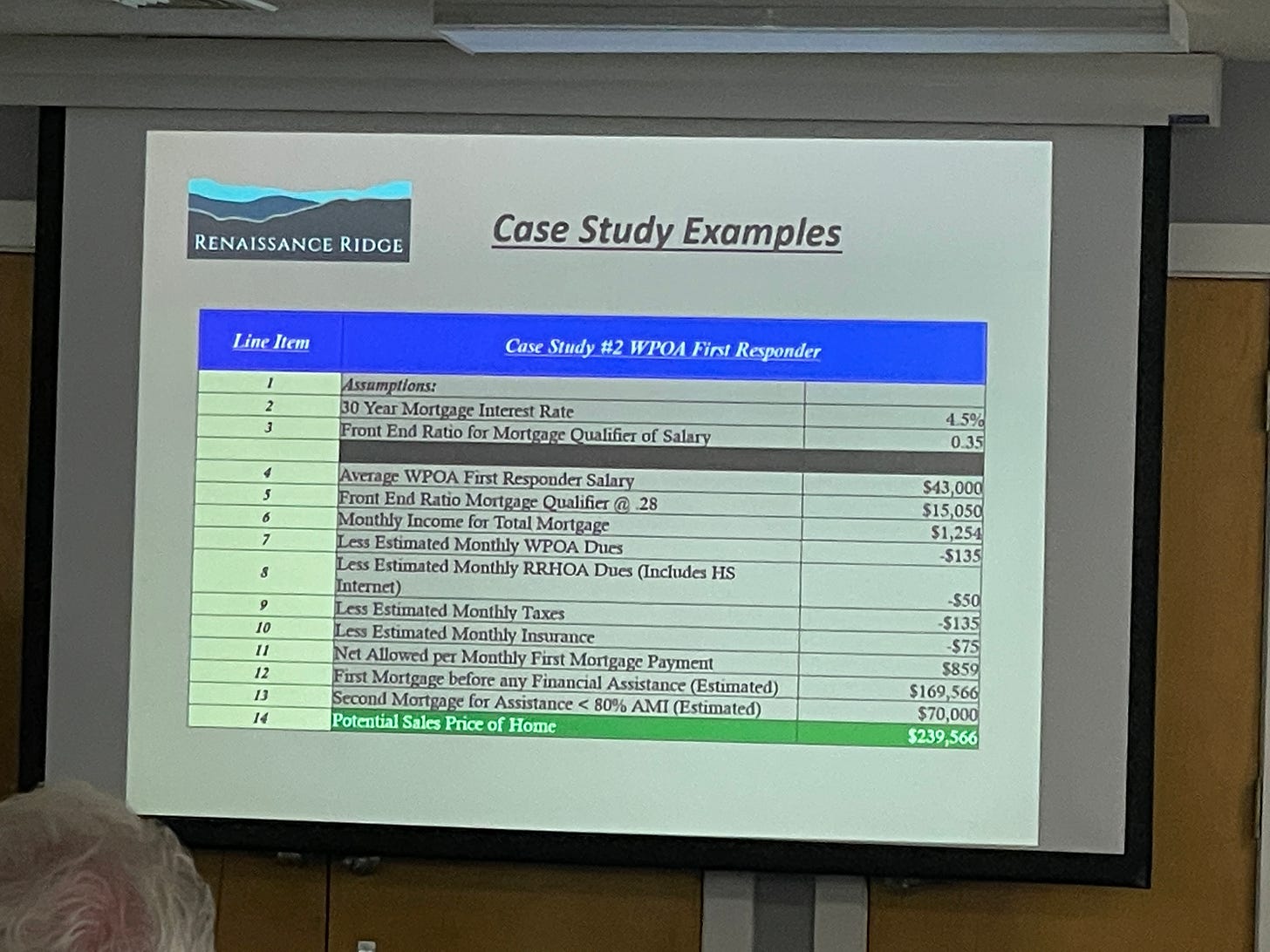

Now, let’s touch on workforce housing, which RR developers say remains a component of the deal. Here’s where I can’t help but raise an eyebrow: Unless the Feds significantly roll back mortgage interest rate hikes as a means of combatting inflation, that 4.5% 30-year interest rate used in the above case study is largely nostalgic. I think in today’s market, a WPOA First Responder who has his financial ducks in a row is realistically looking at a 6.5% rate for a 30-yr loan. And if we are to assume that this WPOA First Responder will be buying a townhome, I’m guessing the price points for those homes will start around $400k; similar units in Crozet start just shy of that number. Even so, I do realize there are many moving parts that figure into the final calculus of owning a designated workforce home at RR — including financial assistance — so let’s see how things shake out as this project progresses.

Until then, pass the sweet potato casserole.

The developers of Renaissance Rich have operated under the motto, “if we say it enough times to enough people, it will be believed”. The truth is in the details. For instance, WPOA dues go up every year. 2023 dues are $164/month, not $135. Short term rentals are being backtracked because of public pressure. That deceleration lane was mandated by VDOT. The community is demanding both right and left turn lanes! Next, would be size of the units. First responders who have no family and can live in 500 sq.ft MAY find it affordable, but I doubt anyone desires to live in a storage unit. Then there is your astute observation regarding interest rates and the current economic environment. This project has been drowning for going on 3 years with not a single permit granted nor shovel in the ground. Ever heard of the term “Vapor-Ware”?