Long term rents leveling off?

After experiencing a spike, single family home rents appear to be normalizing.

Let’s shift our gaze for a moment to the Long-term rental (LTR) market which we know has been tightening in our area. As of this morning, I see one single family rental available in Nelson County, a 2br/1 ba cabin on 7 acres in Arrington for $2200. Back in June, a 3br/2ba single family rental in Shipman with a $1900 monthly rent was scooped up after just 3 days on the rental market. Echoing that activity, CoreLogic released a report earlier this month that reveals a leveling off of recent rent surges for single family homes. (I think drawing a distinction between the apartment rental landscape and single family homes is important in our neck of the woods given the fact that most condos are Short-term rentals (STRs) and the few Long-term rental (LTR) offerings in Nelson County are single family homes).

I love graphs. Here’s a good one that includes data from August 2022.

The chart suggests that rents rise and fall very much in tandem across all tiers, with high tier properties showing more volatility. Check out that 2009 dip: High tier rents slid first and furthest. The same is happening now in 2022. Can anyone say, ‘Canary in the coal mine?’

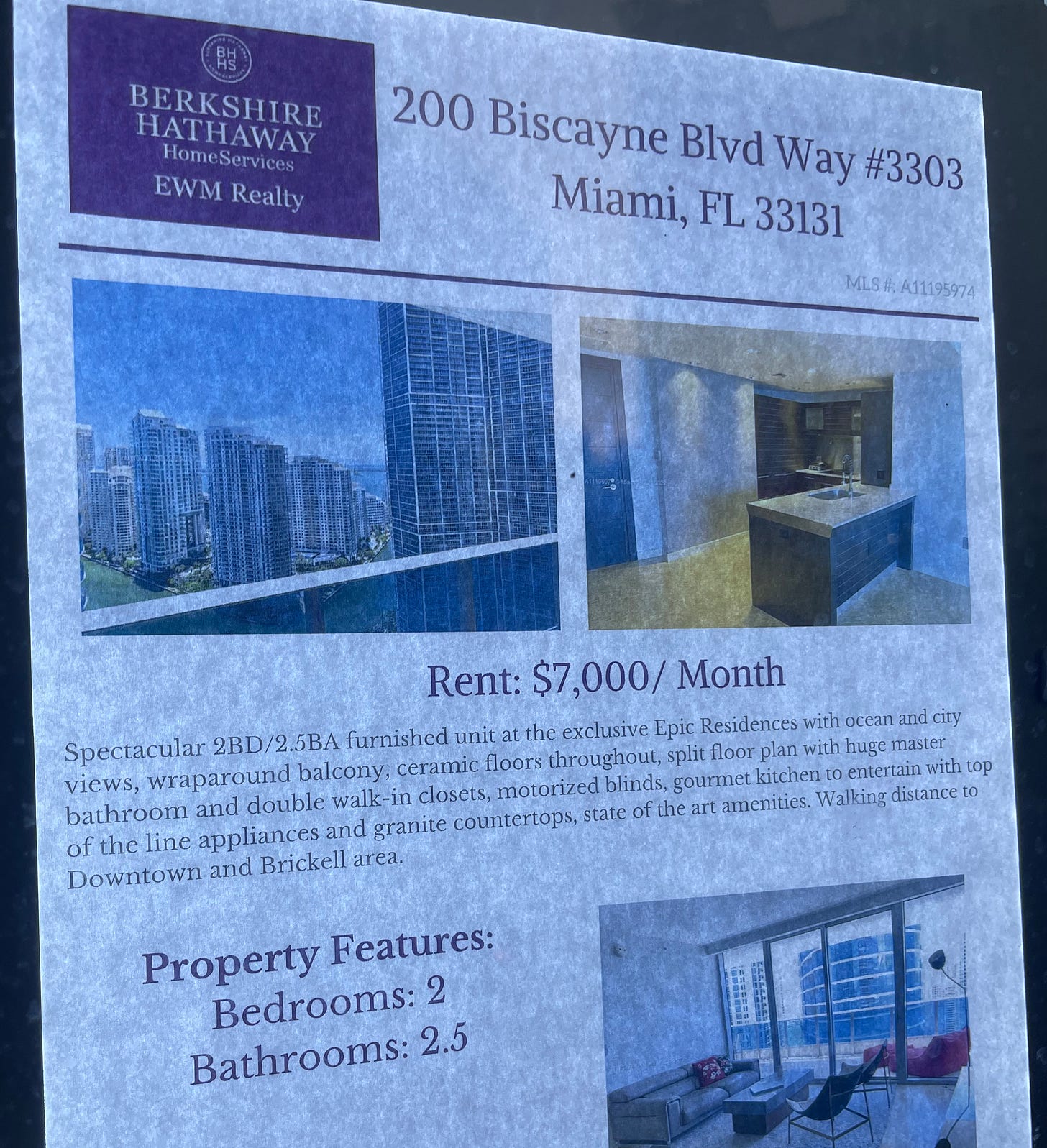

It is worth noting that CoreLogic gathers data from large markets. Closest to us on that list is the Washington, D.C. area, ranking 16th out of 20 markets measured, experiencing an increase of 8.3% year over year, with a median single family home rent price of $2725. And guess what? With today’s rates, that’s still higher than your monthly payment with a 30-year mortgage on a $500,000 property where the buyer is slapping down 20%. The market experiencing the highest rent surge is Miami with a 25% increase, resulting in a median single family home rent of $2588.

I believe it. I took a quick trip to Miami last month with my daughter and stayed in the Brickell area where people there take athleisure to a whole new level. I’m looking at you, Giselle Bündchen.

CoreLogic releases its next report mid November, which will be compiled from September data. In the meantime, we might as well crack open a window and give that canary some ventilation.